By Reid DeRamus

For a more detailed discussion of this topic, please visit Reid’s full post on the Ellation Blog.

There is no silver bullet when it comes to improving user retention — it’s an ongoing cross-company effort and must be ingrained into the team’s culture. However, a flawed approach to measuring retention undermines any initiative or cultural focus on improving it, so ensuring the right metrics are being used effectively is imperative.

Churn rate is the most commonly used measurement of retention, but there are inherent shortcomings that often result in misleading analysis and unsound decision making. Let’s begin by defining retention and churn rate, and then dive into the limitations of relying solely on churn rate as a measurement of retention.

Retention

For subscription businesses, retention is typically based on successful billing cycles, and is expressed as a percentage of a cohort that reaches a particular billing cycle. An example of this would be isolating new paying subscribers added during a given month, and then observing the proportion that are successfully charged the second time, the third time, and so on. This is effectively a subscriber decay curve, which forms the basis for measuring average customer lifetime and, is independent of churn rate.

Churn Rate

Churn rate is an important growth metric and measure of business sustainability. A high churn rate indicates that customers are cancelling quickly and the service is burning through its total addressable market, becoming increasingly reliant on costly customer acquisition to fuel growth. Soaring churn rates are typically accompanied by product deficiencies, an inferior marketing strategy, lack of product/market fit, or competitive pressure, among many other dynamics.

Churn rate has become a universally applied retention metric in large part due to it’s simplicity: calculating churn rate requires a few inputs, can be measured upon launch, and uses a straightforward formula. While there is no universal standard, there are two primary methodologies for calculating churn rate; either methodology is effective as long as the same formula is used consistently over time.

The first methodology calculates churn rate as the number of paying subscribers that cancel their subscription during a period of time (numerator), divided by the total number of paying subscribers that had the opportunity to cancel during that period of time (denominator).

Pay Cancels / (Beginning Pay Balance + New Paying Subscribers Added)

An alternative method is to look at cancels relative to the average number of paying subscribers (vs. the total number of paying subscribers in the methodology above). Here the denominator becomes the average of the number of paying subscribers at the beginning and the end of the period.

Pay Cancels / (Average [Beg. Pay Balance , End Pay Balance])

Shortcomings & Common Misuses of Churn Rate

Unfortunately, the simplicity of churn rate also presents a few key dependencies that occasionally produce confounding and deceptive results. A key limitation of the churn rate formula is its sensitivity to fluctuations in cancels, which are inherently linked to the number of recently added paying subscribers.

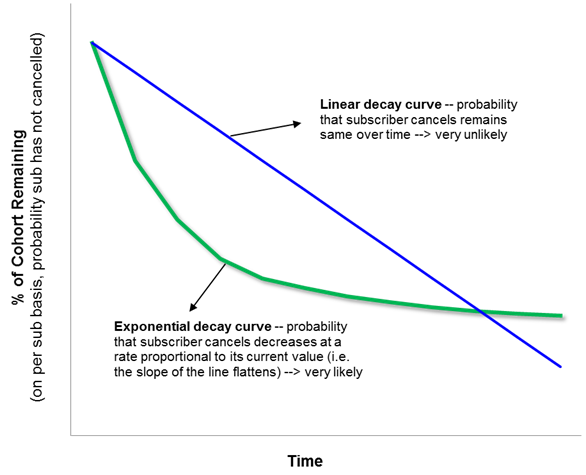

Customer decay curves are almost always exponential, not linear, with the probability of a subscriber cancelling being much higher during the initial months of their subscription. The image below shows the difference between a linear and exponential decay curve, with the Y-axis representing the probability a subscriber is retained at a given point in time (X-axis).

To improve churn rate, the growth of the subscriber balance (denominator) has to outpace the growth of cancels (numerator). This is especially challenging when there is an influx of new subscribers. As a greater portion of the subscriber base shifts towards recently added members—many of whom cancel during their initial months—the growth of cancels accelerates.

When analyzing churn for an individual company, the expectation should be for churn to decrease over time. However, an improvement in churn rate is not dependent upon an improvement in retention. This means that churn rate can (and often will) decrease despite no change in average customer lifetime.

All else equal, this also means that profitability on a per subscriber basis remains the same (i.e. customer lifetime value is stagnant). That churn rate can improve without an underlying improvement in customer lifetime diminishes the purpose of the metric — to evaluate retention over time.

Misused to Determine Customer Lifetime Value

A common methodology for calculating customer lifetime is to simply divide 1 by the churn rate. For example, a monthly churn rate of 5% would imply a 20 month average lifetime (1 / 5% = 20 months). The key assumption here is that the probability that a subscriber cancels in a particular month remains constant in perpetuity.

This is fundamentally flawed — as noted above, the probability that a subscriber cancels is much higher during the first few months and decreases exponentially, moving towards zero in the outer months. Determining customer lifetime is the backbone of the customer lifetime value calculation; using an oversimplified methodology to determine customer lifetime amplifies the margin of error, increasing the likelihood of inaccurate results and ill-advised decision making.

Summary

Improving retention is frequently the lever that can drive the greatest gain in customer lifetime value, a top priority for subscription businesses alongside subscriber growth. There is no silver bullet — building relationships with your audience and extending customer lifetime is an ongoing effort and must be a primary initiative across the company.

Prioritizing retention as a core goal has to be accompanied by a strong approach in measuring retention. For churn rate to be an effective metric, it requires an understanding of its limitations. It should be one component of a more holistic approach to measuring retention that includes segmenting cancels (i.e. by subscription duration or engagement), analyzing retention rates, and leveraging user feedback (i.e. net promoter score and exit surveys).

For more insights into Crunchyroll’s strategies, catch Reid DeRamus and Zuora’s Craig Barberich in our webinar – The Renaissance of Media: How Crunchyroll’s Fans are Driving the Future of Streaming Media!