The following is an excerpt from Citigroup’s article, Signing up to the subscription economy.

Asia embraces the engagement age

Businesses in North America and EMEA were early adopters of the subscription model, but Asia Pacific organisations are also now running with the challenge: Zuora’s index shows 16% revenue growth of subscription economy businesses in the region in 2018.

According to Anna Choi, Head of Digitalization, Asia Pacific, at Schindler Group, a manufacturer of elevators and escalators, customers were not used to subscription pricing until fairly recently. ‘In 2019, however, they are starting to see the value and are willing to pay [on a recurring basis],’ she says. ‘Demand for subscription in Asia is growing strong and becoming more sophisticated.’

Companies in the region building a subscription model are finding that success takes time. More than four in ten respondents (44%) to our survey say implementation of the model has been slower than anticipated, and 41% report little or no progress at all to date.

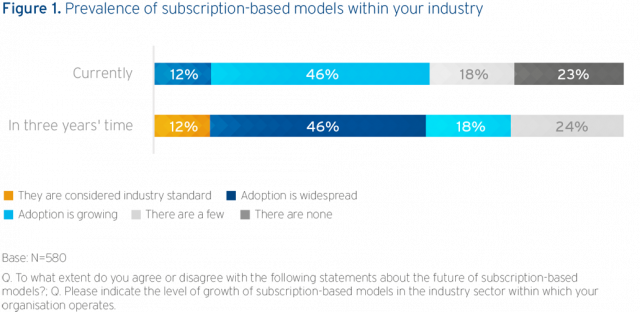

Nevertheless, the survey provides a clear indication of subscription’s appeal. Nearly half (46%) of respondents see adoption growing within their industry today. Fast forward three years and 46% predict that subscription will be widespread in their industry, and 12% even believe it will be the industry standard.

Respondents in TMT and consumer and healthcare are the most upbeat about subscription growth, which is reflected in recent subscription initiatives in these sectors. Examples include China’s Xiaomi, a consumer electronics firm that in 2017 began offering a monthly subscription to its mobile services3. In 2018 Grab, Singapore’s popular ride-hailing service, began offering a subscription plan for customers looking to obtain discounts on rides and food deliveries4.

Industrial manufacturers are also now testing the subscription waters. One example is Geely, a Chinese auto producer that plans to launch a carsharing service in autumn 20195.

‘Adopting a subscription model is an evolutionary journey,’ says Saurabh R Gupta, Director, Asia Pacific Sales Sector Head for Consumer & Healthcare, Treasury & Trade Solutions, Citi. ‘Industries will evolve at different inflection points. In the consumer industry, the inflection point has already come. In an industrial context, some sectors are capital intensive and there are bigger barriers to entry.’

Why the subscription model sells

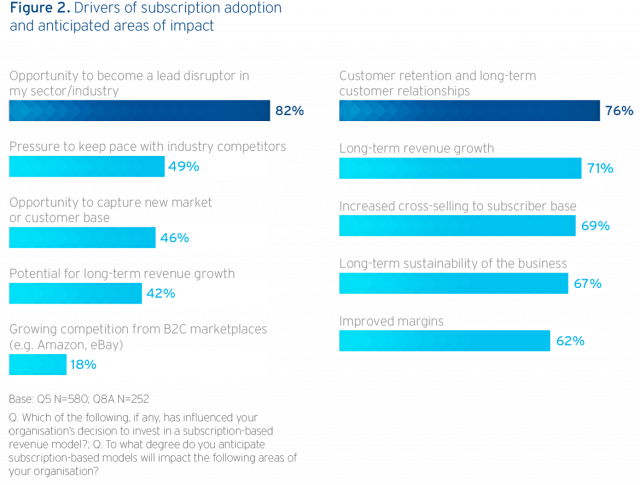

What’s driving companies in the region to develop a subscription model? One factor is, simply, intense competition. Almost half of respondents cite pressure to keep pace with market rivals. But the vast majority (82%) also see an opportunity to become a lead disruptor in their industry.

At another level, most respondents expect subscription to have a positive impact on long-term revenue growth, but even more expect the biggest gain to be better customer retention and stronger customer relationships. Increased cross-selling to the subscriber base is one way that greater retention will contribute to overall revenue growth.

One of the most effective ways to unlock these benefits is by mining the huge amount of data that recurring transactions with customers brings in comparison with one-off product sales. ‘Once you build a subscription relationship with a customer, you gather usage data from them regularly and you get to know them better,’ says Michael Mansard, Principal – Business Transformation & Innovation at Zuora. ‘As they pay for this relationship, they accept the mutual sharing of insights. That creates the ultimate competitive moat.’

Such mining and analysis of data can clearly work to mutual advantage, further cementing relationships. According to Ms Choi, Schindler’s customers use its data to better understand and serve their own customers.

This points to another motivation for subscription adoption: demand. ‘In our avionics business, we’re selling to companies that are very advanced in their own transformation,’ says Stephan Liozu, who is Chief Value Officer with the Thales Group, a technology company. ‘They tell us that they need the subscription option, so we have to adjust and be ready to respond.’

Four in ten respondents (41%)—and 64% of CFOs— say that customer expectations are driving pressure to improve experience faster than their organisation can deliver it. This pressure is most in evidence in the consumer/healthcare, insurance, and energy and power sectors.

Juliana Chua, Head of Digital Transformation at NTUC Income (Income), a Singapore-based insurer, says that digital natives are seeking more pricing flexibility and transparency in insurance products. ‘So, the challenge for us is to personalise insurance into right-sized products that customers can subscribe to.’

‘Insurance has a long-established business model,’ adds Ms. Chua. ‘We want to disrupt ourselves before disruption finds us, deliver an excellent customer experience, and immerse ourselves in a digital ecosystem play with a variety of partners.’ Income has recently taken a step in that direction by launching a partnership with ZhongAn Tech, a Chinese insurance technology provider. Income’s aim is, with its partner’s collaboration, to reach digitally savvy and previously inaccessible customer segments with new products6.

Eric Cheung, Group Transformation Director of Tricor Group, a leading business expansion specialist, highlights another big advantage that C-suite executives see in the model: cash-flow predictability. ‘In the traditional model,’ he says, ‘one-off revenue can occur at any time during the year. But, with subscription, we get regular cash flow and can predict what the customer lifetime value will be. Annual budgeting is a bit complicated at first, but then it gets easier.’

As we will see, by highlighting such advantages, the internal champions of subscription pricing can help to gain vital buy-in to the model from the CFO and finance function.